We Make Business Financing Simple

Whether you’re looking to grow your business, run daily operations, or maintain a safety net to stabilize cashflow for the unexpected, Kapitus has a financing option to fit your unique business needs.

Why Consider Kapitus?

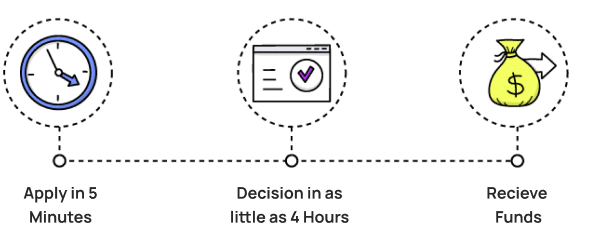

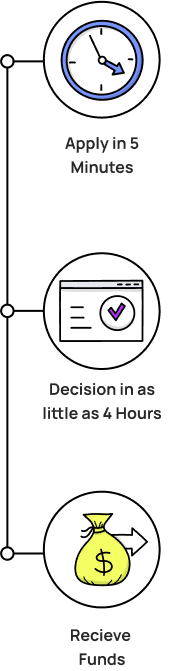

Because business financing doesn’t need to be complicated – especially in this economy. Kapitus is a trusted NON-BANK financing company, that has provided over five billion dollars to small businesses across the country. Businesses just like yours. Our process is quick and easy. Our paperwork requirements are minimal. And, we make it possible for you to receive and compare up to six financing offers through ONE application. Don’t take on your next business challenge alone. Apply now and see how financing from Kapitus can help your business not just endure these uncertain economic times but prosper within and beyond them!

In Their Own Words

Hear what Kapitus clients have to say about their unique financing journeys.