Copyright 2026 Strategic Funding Source, Inc. All rights reserved. Kapitus and the Kapitus logo are registered trademarks of Strategic Funding Source, Inc. Loans made or brokered in California are made or brokered pursuant to California Finance Lenders License No. 603-G807.

What to Expect

Revenue-Based Financing at a Glance

Financing Amounts

Up to $5,000,000

Payment Period

Averages 6 to 24 Months

Payment Frequency

Daily, Weekly, or Monthly

Available Through

Kapitus & Our Financing Network

Revenue-Based Financing 101

What is revenue-based financing?

Revenue-based financing is a flexible financing option that makes it possible for you to access the funding you need without giving up any equity in your business.

Using revenue-based financing, your business receives funding from a financing company in exchange for a percentage of its ongoing revenue.

Unlike traditional loans, where fixed monthly payments are made regardless of how well your business is doing, revenue-based financing lets you pay down your financing using a percentage of your business’s revenue until a predetermined total amount is reached.

Because revenue-based financing is tied directly to a small business’s regular revenue performance, during periods of high revenue, the payment amounts are higher, while during periods of low revenue, payment amounts decrease

Is revenue-based financing debt or equity financing?

Revenue-based financing is, technically, neither debt nor equity financing since funds are received through the financing company’s purchase of a small business’s future sales.

While revenue-based financing can look like debt financing since you will be receiving a lump sum of funds from your financing company and then making payments to your financing company, there is no interest involved. Instead, there is a fixed cost to the financing, based on a factor rate, that is paid back with a fixed percentage of your revenue – on a daily, weekly or monthly basis, depending on your final agreement.

Revenue-based financing does not pass over any equity to the financing company, meaning the financing company will not have any ownership of your company like it would with venture capital or any other form of equity financing. Instead, revenue-based financing is a flexible option that allows you to get the funds you need, while still maintaining full control and ownership of your business

Benefits of Revenue-Based Financing

Financing Amounts up to $5 Million

Get the funds you need for inventory, marketing, repairs, working capital and more without the need to put up personal assets as collateral.

Daily, Weekly, or Monthly Payments Available

Enjoy flexible payment frequency that fits you and your business. ACH payments are conveniently debited from your bank based on an agreed upon percentage of your business’ receipts daily, weekly or monthly receipts.

Minimal Paperwork

Complete your application in as little as 10 minutes. We respect your time and only ever ask for what is necessary to complete your funding.

Quick Approvals

A simple application means quicker approvals! Applications can approved in as little as 4 hours and qualified businesses can receive funds in their accounts in as little as 24 hours.

Getting Approved for Revenue-Based Financing

Minimum Qualifying Requirements for Revenue-Based Financing

As with all financing options, business owners must meet minimum requirements to qualify for revenue-based financing. These requirements are used to evaluate the health of your business and determine the best financing arrangement for you. Here are the basic minimum requirements involved when applying for revenue-based financing:

Time in Business

2 Years

2 Years

Annual Revenue

$250,000

$250,000

Credit Score

650

650

Location

USA

USA

Understanding Revenue-Based Financing Requirements

All business financing options take into account important factors assessing your business for funding and revenue-based financing is no different. With this type of financing, your revenue is one of the most important items considered because it revolves around an investment in your future sales. Here are a few of the factors we consider and why:

Annual Revenue

As the name implies, revenue is a critical consideration for revenue-based financing approval. Since payments are based on a percentage of your future revenue, we need to ensure that the money coming into your business is enough to handle payments while still allowing your business to grow.

Time in Business

A minimum of 2 years in business is required to qualify for revenue-based financing as it can show us a solid history of successful sales and that your business has the potential to manage the ups and downs of daily operations.

Personal Credit Score

While less important during the underwriting process than it would be for other financing options, a good credit score is still needed to qualify for revenue-based financing. Your personal credit score gives us an idea how you typically handle finances on a personal level, and can, therefore, give us a window into how you likely handle your business finances.

Some additional elements that are taken into account during the underwriting process include your location, industry and whether or not you hold a business bank account. While these are not the only details considered during the underwriting process, they are the core items reviewed. However, additional criteria may be considered as final financing decisions are made.

Wondering if your business can benefit from revenue-based financing?

Speak with a Kapitus Small Business Financing Specialist to learn more.

How Can You Use Revenue-Based Financing to Grow Your Business?

Revenue-based financing is an excellent financing tool for small business owners to take advantage of growth opportunities they otherwise would have passed on due to insufficient cash flow. Here are just a few ways revenue-based financing can be a successful tool to grow your business.

Expand Your Footprint

Introduce new products and services, move to a larger location, build out your current location. However you’re looking to expand your business, revenue-based financing can help.

Add to Your Team

Have a new project but not enough manpower to execute it? Use revenue-based financing to cover the cost of new or temporary employees to get your project off the ground.

Enhance Your Marketing

Marketing is critical to bring in new customers and extend the lifetime value of existing customers, but it can be expensive. Revenue-based financing can help cover the cost.

Modernize Operations

Looking to modernize your office or bring in updated technology to streamline and speed up operations, revenue-based financing lets you do so without impact to cash flow

Understanding Revenue-Based Financing

How Revenue-Based Financing Works

Revenue based financing is not a loan. Instead, it is a unique financing solution designed to align with your business’s growth.

The process goes as follows:

- A financing agreement is established between Kapitus and your business.

- Your cash can be deposited within 24 hours so you can immediately tend to your financial needs.

- Operate your business as normal. As it generates revenue, you’ll pay Kapitus a predetermined portion of your revenue based on your business’s performance. Pay less during slower periods and more during prosperous periods.

Once the agreed-upon total amount is paid, your obligation is fulfilled. Focus on your business growth without losing equity.

How do Revenue-Based Financing Payments Work?

Revenue-based financing differs from traditional loans in that it is not a loan at all. Rather, it is a flexible financing solution designed to align with your business’s growth.

There is no true fixed timeline for repayment, no interest, no set monthly payments, and no APR. Instead, the cost of financing will be expressed with a factor rate.

You’ll pay for your financing using a percentage of your business revenue that correlates with your business’s performance. When your revenue is higher, your payment will increase, and when it is lower, payments will decrease accordingly, providing a level of flexibility aligned with your cash flow.

Payments will continue until the financing amount and any additional fees are paid off. At that time, your obligation will be complete.

Pros & Cons of Revenue-Based Financing

Navigating any kind of debt always comes with pros and cons. Make an informed business decision by exploring the pros and cons of revenue-based financing before you apply.

Advantages of Revenue-Based Financing

Accessibility

If you have a small business that does not qualify for traditional bank loans due to credit history or collateral requirements, revenue-based financing’s less stringent requirements can be an opportunity for you to get the financing you need.

Speed of Financing

With less stringent requirements and significantly less documentation needed to apply for revenue-based financing, decisions can be made quickly – many times within four hours. Once approved, funds can be deposited into your business bank account in as little as 24 hours, quickly giving you access to the cash you need to take advantage of growth opportunities.

No Fixed Monthly Payments

Payments are based on a percentage of revenue, so they adjust according to your business performance, making things more manageable during periods of decreased revenue.

Disadvantages of Revenue-Based Financing

Higher Total Cost

The total cost of revenue-based financing can be higher than traditional financing in some scenarios.

Longer Payment Periods

Since revenue-based financing payments are tied directly to revenue, slow periods may extend the payment period.

Potential Impact to Cash Flow

Deductions taken from sales for payments on your funded amount can reduce your available working capital, potentially leading to cash flow struggles. Prior to taking on this type of financing, you should analyze your business’s cash flow projections to be sure that this type of payment and payment frequency are manageable for you and that they will not impact your day-to-day operations.

Who Should Use Revenue-Based Financing?

Virtually any industry can benefit from revenue-based financing. However, the industries that most frequently take advantage of this flexible financing tool are:

- Personal Services

- Business Services

- General Contractors

- Restaurants

- Retail

- Specialty Trades

How Small Business Owners Use Revenue-Based Financing

Revenue-based financing can be used for essentially any business purpose. Here are just a few examples that illustrate how small business owners can use Kapitus to unlock their business potential with revenue-based financing.

Heavy-duty Business Growth

Jose owns a small construction company and would like to expand his business. However, he realizes that he is missing out on the larger projects he needs to grow simply because of his limited equipment resources.

Because he knows that having this equipment will allow him to take on bigger and higher-paying projects, he takes advantage of revenue-based financing to purchase a fleet of excavators, loaders, and heavy-duty trucks for his business.

Now able to complete bigger projects with greater precision, Jose’s company begins to impress clients and attract more inquiries for more major construction projects.

Adding Success to the Menu

Elaine, a dedicated restaurant owner, finds herself at a crossroads when her little bistro starts gaining popularity, to the point that her current kitchen is no longer able to keep up with the constant stream of patrons.

In order to maintain the quality of her menu and her positive reputation, upgrading her kitchen and expanding her space is her only option.

Using revenue-based financing, Elaine secures funding that allows her to invest in top-of-the-line kitchen equipment, create additional indoor and outdoor seating, and enhance the overall dining experience of her patrons.

Now with a state-of-the-art kitchen and the space she needs, Elaine’s bistro is enjoying a huge boost in revenue, allowing her to enjoy her surge in business and easily repay her financing.

Purrr-sistence Pays Off

After maintaining a pet grooming salon out of his home for a few years, Jeremy soon realizes that his growing list of clients is now exceeding the space he has to work with.

Instead of losing clients, he sees the potential to take his pet grooming business out of his home and into a dedicated facility to accommodate more pets and expand his range of services.

Because other sources of funding don’t align with his business goals and budget, he decides to use revenue-based financing as a flexible financing option to help him realize his business dreams.

Jeremy was quickly able to secure the funds he needed to lease a larger space, hire additional staff members, and invest in state-of-the-art grooming equipment.

Soon, Jeremy is seeing a significant increase in demand for his services and, with his new facility, he is able to keep up with demand and generate more revenue than ever before.

Getting Started with Revenue-Based Financing

Before you Apply

Before taking on any additional debt, we recommend that you thoroughly examine your business needs to see if revenue-based financing is the right choice for you.

Evaluate Your Needs

It’s very important to thoroughly evaluate your business needs and objectives before applying for any kind of financing to ensure that your plans combined with revenue-based financing is the best fit for your business’s growth.

Check Your Credit

A minimum credit score of 650 is necessary to qualify for revenue-based financing.

We look specifically at credit scores because the way you handle your personal debt very often mirrors how you handle your business debt.

Research & Select a Financing Company

Be sure to devote some time to researching various financing companies and their available financing options before you sign a revenue-based financing agreement. Carefully examine terms, factor rates, and customer feedback to help you make an informed decision.

If you need further guidance in evaluating your financing choices, our team of financing specialists can help you find the best-suited solution for your business needs.

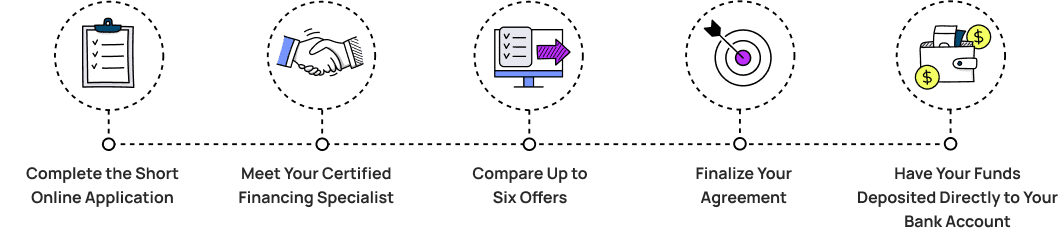

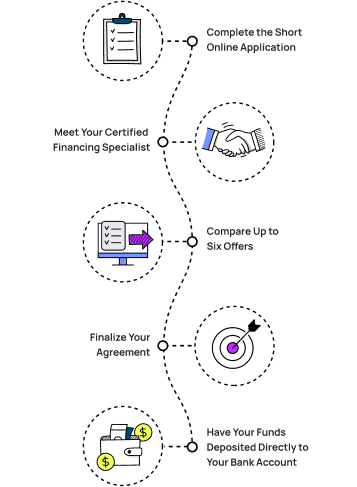

How do I Apply for Revenue-Based Financing?

Applying for revenue-based financing with Kapitus is a quick and easy process.

Simply follow the steps outlined below:

- Complete the short online application

- Upload 3-6 bank statements

- Meet your Financing Specialist

- Discuss terms

- Finalize your agreement

Using Revenue-Based Financing Funds Wisely

Because revenue-based financing can be an expensive financing option, it is important that you use your funds wisely.

It is recommended that any funds from revenue-based financing are used for strategic investments that have the potential to generate higher revenue, such as expanding your product line, launching a new marketing campaign, or investing in technology or other improvements that increase your business’s efficiency and range of services.

While we cannot give a personal guarantee that these types of investments will generate more revenue, it’s crucial to calculate your potential ROI before making any financial commitments.

What to do if You’re Declined for Revenue-Based Financing

If after reviewing your application, it is determined that your business is not eligible for revenue-based financing, then that does not mean your funds are out of reach.

Contact one of our financing specialists to see if another financing option is a better fit for you and your business.

Table of Contents

How Revenue-Based Financing Works

Pros & Cons of Revenue-Based Financing

Who Should Use Revenue-Based Financing

How Small Business Owners Use Revenue-Based Financing

Getting Started with Purchase Order Financing

How do I apply for Revenue-Based Financing

Using Revenue-Based Financing Funds Wisely

What to do if You’re Declined for Purchase Order Financing.

Ready to Get Started?

Applying for revenue-based financing is a quick and easy process with minimal documentation required. To get started simply fill out our online application and upload a few bank statements.

Revenue-Based Financing FAQs

Is there a difference between revenue-based financing and revenue-based funding?

While these two terms are often used interchangeably, they refer to different concepts.

Revenue-based financing (RBF) involves businesses obtaining capital from a financing company in exchange for a share of future revenue. Regular payments are made by the business owner to the financing company based on a fixed revenue percentage until a predetermined cap is met.

“Revenue-based funding” is a broader term that can refer to various funding methods, including RBF, where revenue plays a significant role in determining the financing structure, including profit sharing or performance-based loans.

Is revenue-based financing a loan?

No. While revenue-based financing does provide capital to a small business, the structure and terms are different. Unlike a traditional loan, it has no APR, interest rates, or set repayment amounts or timelines.

Can newer or “startup” businesses use revenue-based financing?

Technically, yes, in rare cases. Revenue-based financing is a particularly attractive financing option for some newer or “startup” businesses. However, because it is heavily based on your revenue, you need to actually have a solid history of producing revenue, so a newer business or “startup” looking at revenue-based financing as an option typically must have been in business for at least two years. In some cases, some businesses that don’t quite meet that two-year mark may be considered if they have an extremely strong sales history and revenue.

Does my business need to be profitable to get revenue-based financing?

To qualify for revenue-based financing you must have an annual revenue of $250,000.

Is revenue-based financing risky?

In some scenarios, it can be, just like any business financing option – especially if the funds provided are not used responsibly.

The level of risk depends on the specific circumstances of your business and the terms of your revenue-based financing agreement, and how you end up using the money provided.

Consult with one of our financing specialists to determine if revenue-based financing is the solution for your business needs or if another financing product would better suit your situation.

How much money can I get with revenue-based financing?

Businesses can receive up to 5 million dollars with revenue-based financing. The exact amount your business could receive, however, is dependent on a number of factors including your credit scores, annual revenue and industry.

Complete an online application to see how much your business qualifies for.

What is a factor rate?

A factor rate is a different way of representing the cost of funds received during financing. While business loans typically express this cost in interest or APR, many non-loan financing products express the cost as a factor rate.

The factor rate is expressed as a decimal or a percentage of the total amount funded and it determines the total amount you’ll need to pay to your financing company. Unlike APR, the factor rate is a fixed percentage applied to the financing amount.

For example, if you receive $45,000 in financing, and your factor rate is 1.15, you’ll pay 115% of the amount you received, which comes to $51,750.

How long does it take to apply for revenue-based financing?

Kapitus applications can be completed in as little as 10 minutes.

I am already a Kapitus customer. Can I obtain additional financing through Kapitus?

Of course! As a valued client, we already have a deep understanding of your needs and the intricacies of your business, making the process for additional financing even easier. Schedule a call to learn more about our robust renewal options and other resources.