Copyright 2024 Strategic Funding Source, Inc. All rights reserved. Kapitus and the Kapitus logo are registered trademarks of Strategic Funding Source, Inc. Loans made or brokered in California are made or brokered pursuant to California Finance Lenders License No. 603-G807.

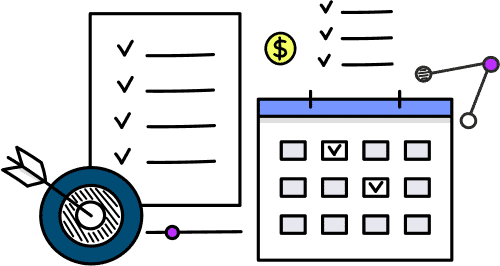

Invoice Factoring at a Glance

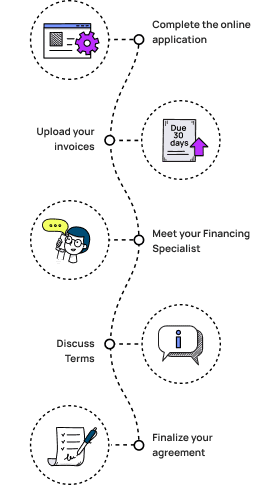

What to Expect

Factoring Lines

$200,000 – $7,000,000

Payment Period

30 days – 120 days

Funding Turnaround

As little as 4 days

Available Through

Kapitus Financing Network

Invoice Factoring 101

What is Invoice Factoring?

Invoice factoring, also called factoring receivables, is a financial transaction where a business sells its invoices to a third party (a factoring company). In return, the business receives an advance based on a percentage of the total value of the invoices. The factoring company then assumes responsibility for collecting payments from the customers who owe the outstanding balances.

Understanding Factoring Receivables

Whether you know this financing strategy as “factoring receivables” or “invoice factoring,” many businesses choose to factor invoices to enhance their cash flow and business growth.

By selling invoices to a factoring company, a business gets an immediate payment instead of waiting on outstanding balances to be paid, helping improve cash flow and facilitate continued growth and operations.

Benefits of Invoice Factoring Through Kapitus

Cash Flow Without the Debt

Because invoice factoring is not a loan, it does not add additional liabilities to your balance sheet. Instead, it allows you to collect an advance on invoices for services/products you’ve already provided so that you don’t have to wait on your customers to remit payment after 30, 60 or 90 days, potentially interrupting operations due to lack of cash flow.

The Cash You Need When You Need It

Cover funding gaps with quick access to working capital. Receive cash for your outstanding invoices in as little as 4 business days instead of waiting 30–90 days for payments. At the same time, you can use invoice factoring as a value-add to loyal customers by allowing longer payment terms without the impact to your cash flow.

Easier Qualification Requirements

When compared to qualification requirements for other types of financing – such as business loans – invoice factoring, which prioritizes the value of your invoices along with the creditworthiness of your clients, can be a great option for businesses that would not qualify for more traditional financing products.

Traditional Collateral Not Required

Because invoice factoring is, essentially, the sale of your invoices, those invoices will typically serve as the collateral for your funds. Because of this you don’t need to put any additional business assets – such as real estate, equipment, vehicles or inventory – at risk.

Getting Approved for Invoice Factoring

Minimum Requirements for Invoice Factoring

Before you can secure funds through invoice factoring, you and your customers must meet certain requirements. Here are the minimum requirements that must be met.

- Outstanding Invoices Between 30-90 days

- Creditworthy Customers

- Invoice Aging Report

- Your Business’s Articles of Incorporation

- Business Bank Account

- Your Company Must be Categorized as B2B (business-to- business) or B2G (business-to-government).

Understanding Invoice Factoring Requirements

Invoice Factoring for small businesses comes with a set of minimum requirements to serve as a safeguard for all parties involved. Here are some of the factors that are considered:

Creditworthy Clients

Factoring companies want to be sure that your clients have a history of timely payments and are financially stable prior to purchasing and advancing funds on their invoices. Your clients’ business credit can give the factoring company a good snapshot of whether they meet their invoice obligations on time and how they handle their business finances overall.

The Invoices

Since the entire basis of invoice factoring is purchasing outstanding invoices and advancing payment on them, it goes without saying that your invoices need to be valid, for goods and/or services that you have already delivered and completely free of any liens.

Company Category

Invoice factoring companies will only purchase high-quality invoices that come from clients that can showcase they can meet significant invoice obligations. Consumer invoices typically don’t meet these requirements so factoring companies will purchase your invoices only from commercial (B2B) or government (B2G) entities.

Of course, these are not the only criteria needed for invoice factoring. Additional qualifications may be required based on the health of your clients’ credit worthiness, the outstanding amounts and ages of your invoices, and the financial health of your own business.

Invoice Factoring FAQs

What is the difference between invoice factoring and invoice financing?

While these are both financial solutions that involve using unpaid invoices to access working capital, they differ in structure and how they operate. Here is a breakdown:

Invoice Factoring — With invoice factoring, the factoring company purchases your unpaid invoices outright, meaning that they assume ownership of your invoices and are now responsible for collecting payments from your customers. Once an invoice is submitted to the factoring company, you receive an immediate advance on those invoices with the remaining percentage, minus fees, provided once the customer pays the invoice.

Invoice Financing — With invoice factoring, you retain ownership of your invoices. Instead of selling them, you use them as collateral to secure a loan from a bank or other financial institution. The loan you receive will be a percentage of the invoice value, which you will repay (plus interest and fees) once your customers pay their outstanding balance. During the process, you will continue to manage your collection process and if your customer fails to pay, your business absorbs the loss.

What is the difference between invoice factoring and small business term loans?

Invoice factoring for small businesses involves selling unpaid invoices to a third-party factoring company to receive immediate cash.

Small business term loans involve a business borrowing a lump sum of money with a fixed repayment term and interest rates, offering quick access to working capital with a set repayment schedule and pre-agreed terms.

In short, while both options provide a business with cash, a small business term loan is a loan that must be repaid, and invoice factoring is a transaction.

What is the difference between invoice factoring and invoice discounting?

While these two terms are very similar, they differ in key aspects, which we’ll explore now.

Invoice Factoring — Invoice factoring involves a business selling its unpaid invoices to a factoring company. The factoring company then assumes ownership of your invoices and is now responsible for directly contacting your customers to collect payment.

Invoice Discounting — Invoice discounting is a type of invoice financing. With invoice discounting, you retain ownership of your invoices. The financing company you work with will provide you a loan based on the value of those invoices, meaning that you maintain control over contacting your customers and collecting payment.

Are UCC filings required with invoice factoring?

Yes. All invoice factors require some type of UCC (Uniform Commercial Code) filing.

Is invoice factoring debt?

No. Invoice factoring involves selling an asset to a third party, making it a transaction and not a debt. Because of this, it is not added to your balance sheet.

Who owns invoice factoring debt?

With invoice factoring, businesses avoid taking on traditional debit.

When a business sells its invoices to a factoring company, the responsibility for contacting customers and collecting payments shifts to the factoring company.

This arrangement allows businesses to convert their accounts receivable into working capital without incurring the debt associated with traditional types of financing.

What is a factor rate?

While “factor rates” are used by financing companies as multipliers to determine the total repayment amount for a loan or advance, in the context of invoice factoring, the definition changes.

In invoice factoring, “factor rates” refer to the fees charged by the factoring company to purchase a business’s unpaid invoices.

Is it hard to qualify for invoice factoring?

Qualifying for invoice factoring is often easier than qualifying for traditional financing options, such as small business loans.

Complete the simple Kapitus application to determine your eligibility. If you have further questions about your eligibility, please don’t hesitate to reach out to one of our financing specialists.

Can “newer,” startup companies use invoice factoring?

Absolutely. While some traditional lenders may be hesitant to provide funding to newer, “startup” companies due to their short operating history and lack of established credit, invoice factoring is more accessible.

Factoring companies primarily assess the creditworthiness of the business’s customers rather than the business itself.

Can I do invoice factoring with bad credit?

It’s possible. Invoice factoring is often more flexible than other forms of financing and since it’s your customer’s credit that is focused on, many factoring companies are willing to work with businesses that have less-than-perfect credit.

Complete the quick Kapitus application to determine your eligibility and find a partner who fits your business needs.

How do invoice factoring payments work?

Since there is no traditional debt incurred from invoice factoring, there is no payback involved.

Once a business sells its unpaid invoice to the factoring company, the factoring company then takes on the responsibility of collecting payments from the business’s customers.

What is an invoice aging report?

An invoice aging report, also known as an accounts receivables aging report, is a record of all of a business’s overdue invoices and accounts receivables. It is the report you would pull when you are looking to see which of your customers has an outstanding balance due.