We Make Business Loans Simple

Whether you’re looking to grow your business, run daily operations, or maintain a safety net to stabilize cashflow for the unexpected, Kapitus has a loan fit to your unique business needs.

Why Consider a Business Loan with Kapitus?

Business loans are one of the most versatile forms of business financing available to owners on the market today. They are available in a large range of sizes, come with an array of payment options and there is no limit on the way you can use the business funding options. Whether you were looking to grow, maintain daily operations, or build yourself a cash flow safety net to manage the unexpected, Kapitus can help you build the right loan product and get funding for your business to meet your unique needs.

We Offer Financing for Every Business Need

FAQs

What is the minimum credit score needed for a small business loan with Kapitus?

At this time, the minimum credit score requirement for our small business loans is 625.

What are the current interest rates on Kapitus Small Business Loans?

When calculated, our small business loans have competitive industry rates. However, our loans don’t technically have a rate; instead, we charge one fixed price that does not change. Our pricing may change depending on a number of factors, including your credit score, revenue, your industry, and terms of the loan you choose. Because our loans are short term, when you calculate the “rate,” it will be higher than some other options, but the overall cost is often much less than long-term financing options such as SBA loans or equipment financing.

How is an alternative lender to get a business loan better than using tradional banks?

During the 2008 recession, online lenders gained prominence as an alternative option for many small businesses to obtain financing when traditional bank funding opportunities dried up. Since then, these lenders have become a common-place resource for business funding.While your specific needs should dictate where you seek financing, there are some well-known advantages to using alternative lenders, including:

Qualification Requirements: Alternative lenders tend to have less stringent requirements for approval. Typically, alternative lenders have lower requirements for an applicant’s revenue, time in business, and credit score.

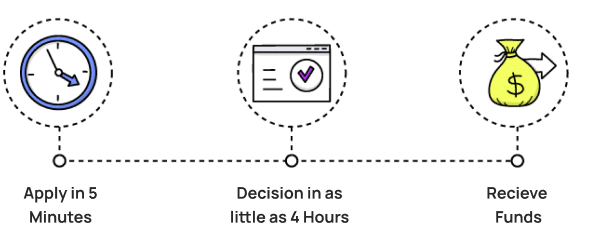

Shorter Timelines: Because of the applications are shorter and fewer documents are required for underwriting, alternative lenders can review, approve and fund business loans in a matter of days – sometimes even in as little as 24 hours depending on how quickly you’re able to get your full application package submitted.

Loan Size Flexibility: Alternative lenders have more flexibility with the funding amounts they will approve, so they are able and willing to finance both smaller and larger amounts than traditional lenders. For example, many banks will not consider loans above $1 Million and the use of those funds is often limited. However, with many alternative lenders, loans are available in amounts up to $5 Million and the funds can be used for any business purpose. If you need less capital, many banks aren’t as willing to lend out lower amounts because it is not economically feasible for them to do so, while alternative lenders are willing to finance amounts as low as $10,000.

Higher Approval Rates: Because of their easier qualification requirements and simpler application process, alternative funders approve financing for more small and medium-size businesses than traditional lenders.