Copyright 2026 Strategic Funding Source, Inc. All rights reserved. Kapitus and the Kapitus logo are registered trademarks of Strategic Funding Source, Inc. Loans made or brokered in California are made or brokered pursuant to California Finance Lenders License No. 603-G807.

Getting the equipment your business needs to operate is crucial to running your business and turning a profit; but equipment can be massively expensive. As a small business owner, fronting large amounts of cash to purchase the equipment you need may severely damage your cash flow.

Fortunately, equipment financing is a tool that can get you the revenue-generating equipment you need without putting a major strain on your business’ finances. Equipment financing offers distinct advantages over purchasing equipment outright. One of the biggest of those advantages is that down payments are not typically required. When it comes to financing equipment, the equipment you’re purchasing serves as the collateral, and that enables you to quickly replace equipment when it becomes outdated.

Despite its many advantages, however, equipment financing may not be the right choice in every situation. Let’s delve into the best use-cases and optimal scenarios where business financing should be considered.

What is Equipment Financing?

Equipment financing is the process of obtaining a loan from a third-party lender (other than the direct dealer) for the equipment your business needs. Whether it’s a CNC processing machine, a tractor/trailer or office computers and furniture, equipment financing can be used by any qualifying business and can be used to purchase essentially any equipment aside from real estate.

Some of the most common types of equipment for which small businesses seek financing are:

Heavy machinery, such as CNC processors, drilling and turning machines and package processors.

Commercial vehicles, such as trucks, cars and vans for delivery and other transportation needs.

Agricultural and construction vehicles, such as backhoes, tractors, bulldozers, cranes, etc.

Medical and dental equipment, such as CT scanning machines, X-ray machines and arm tables.

Restaurant equipment such as commercial ovens and stove tops.

Office Furniture such as desks, cubicles and armchairs.

Computer systems, such as laptop or desktop computers, servers and software.

Who Offers Equipment Financing?

You can obtain equipment financing, including lease agreements, from three different sources: dealers, traditional banks and alternative lenders. If you have good to excellent credit and wish to lease or outright purchase your equipment, getting financing directly from the dealer may be a good solution for you, as the dealer most likely will offer the best interest rates and most flexible repayment plans. You can also negotiate the price of the equipment directly with the dealer.

If you have good credit but don’t qualify for dealer financing, you can buy your equipment through a traditional bank. You can negotiate the repayment terms and interest rates directly with the bank. Traditional banks, however, often require a lot of paperwork and other requirements, and some banks may take several days or even weeks to run through the financing process.

Another option is to use an alternative lender. Alternative lenders usually charge slightly higher interest rates or monthly payments than traditional banks, but if approved, a small business can get funding in a day or less. Alternative lenders often require less paperwork and a slightly lesser credit score than traditional banks and dealers.

Types of Equipment Financing

There are several equipment financing options small business owners can choose from depending on their specific needs:

Direct Equipment Finance Loans

Direct Equipment Finance Loans

A small business can obtain a direct loan from a third-party lender to make an outright purchase of equipment. Like with most loan agreements, the borrower would pay back the loan over time with interest. This is a good option if a small business owner is seeking equipment that will be used over a long period of time.

Equipment Operating Lease

This is a rental agreement that allows a small business to rent a big-ticket item such as a vehicle for a monthly cost that is typically lower than what they would pay for a direct loan. However, this does come with risks, the biggest one being that if the value of equipment is less than it was at the end of the agreement than it was at the beginning, the lessee would owe the difference. For example, if the equipment being rented was worth $1,000 when it was leased and is worth only $800 at the end, the lessee would owe the lender $200 at the end of the agreement,

Sale-Leaseback

Sale-Leaseback

This agreement often involves high-cost equipment that a small business already owns. In this type of agreement, the small business can sell its equipment to a lender, and then the lender then leases the equipment back to the business owner. This allows a small business to get back the cash that they already invested in equipment and yet still use that equipment.

Equipment Line Of Credit (ELOC)

Equipment Line Of Credit (ELOC)

An equipment line of credit is a revolving credit line offered by lenders to small businesses to purchase, maintain and repair equipment. An ELOC eliminates the need for small businesses to get approval for a loan on equipment. However, small businesses that wish to take out an ELOC should closely examine the repayment terms, as they could be dramatically different from traditional equipment financing.

SBA 7(A) Loan

An SBA 7(a) loan is one of the few SBA-backed loans that can be used to purchase equipment. It typically offers the lowest interest rates since much of the loan is guaranteed by the federal government, and it usually offers more appealing repayment terms than private lenders. The application process for a 7(a) loan, however, is usually more stringent, cumbersome and time consuming than any other type of business loan, and funding could take weeks after approval. So if you need to purchase equipment quickly, this may not be the route you want to take.

SBA 504 Loan

SBA 504 Loan

This type of SBA loan is also backed by the SBA and can be used to purchase fixed assets. The loan amounts are up to $5 million and interest rates are typically lower than what a traditional bank or alternative lender might offer, but like the 7(a) loan, the requirements are stringent and funding may take weeks after approval.

What Should you Consider Before Taking out Equipment Financing?

There are several factors to consider when thinking about using equipment financing and the type of financing that makes the most sense for you. The primary considerations include:

Cost of equipment.

Like with any other type of loan, before taking out equipment financing, take a close look at your cash flow to determine how much you can afford to spend on equipment, and whether your cash flow enables you to afford the repayment terms for your equipment.

Use of equipment.

Any time you take on a small business loan, you need to ask yourself if the proceeds of the loan will be used to generate additional revenue, and equipment financing in this regard is no different. Will the equipment you are purchasing or leasing generate enough income for your business to enable you to afford the investment you’re making in the equipment?

Life of the Equipment.

One crucial question you need to ask yourself is whether you will need to periodically upgrade your equipment, whether it be a business vehicle or new computers. This will help you decide whether leasing or owning equipment makes more sense for you.

How quickly do you need to purchase the equipment?

Business moves fast, and so does your need for vital equipment. There are some lending arrangements that provide funds more quickly than others – alternative (online) lenders typically provide faster funding times than traditional banks, while an SBA loan can often take weeks for approval and funding.

Your Credit Score

Like with any other loan application, your credit score will be key. To apply for any type of financing to pay for your equipment, your personal and business credit scores must fall in at least the fair range (650 personal score, 65 business score). If you’re applying for an SBA loan, your credit scores must be excellent. If you’re applying with a traditional bank, your credit scores must still be strong; and if you’re applying with an alternative lender, they still have to be good.

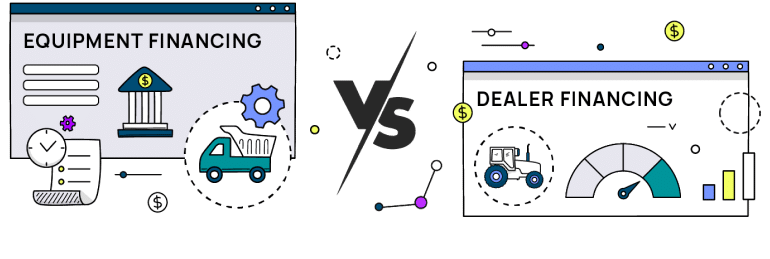

Differences Between Equipment Financing and Dealer Financing

Some small business owners may ask: “why shouldn’t I just get financing from my dealer?” The short answer is that dealer financing is a very valid option since it often offers lower rates than equipment financing. There are, however, significant differences between the two that small business owners should carefully consider.

As the term implies, dealer financing offers a loan option for your equipment directly from the dealer, much like you get when you purchase a personal automobile from a car dealership. While dealer financing may be more convenient, there are aspects of it that you should take note of.

Dealer financing usually:

1. Requires higher personal and business credit scores than equipment financing from a third party.

2. Requires less paperwork than equipment financing.

3. Offers insurance and warranties on the equipment being purchased.

4. Requires the bulk of the paperwork to be performed by the dealer.

5. Typically offers a lower interest rate than a third party equipment finance provider.

While dealer financing may be the first option you examine when purchasing equipment, there are some advantages that third-party equipment financing offers:

1. No down payment is typically required on the equipment being purchased.

2. Less negotiation on the price of the equipment.

3. A slightly lower credit score requirement for financing than dealer financing.

4. Better costs for equipment maintenance.

Small business owners seeking to finance equipment should be aware of the advantages and disadvantages of each rather than automatically choosing one over the other.

Equipment Ownership vs. Equipment Leasing

One of the biggest choices small business owners will face when seeking to purchase equipment is whether they should lease the equipment or own it. H ere are the main pros and cons of both leasing and ownership.

The Benefits of Equipment Ownership:

You Own the Equipment

This may seem obvious, but if the equipment you’re seeking to buy has a long shelf life and strong resale value (if properly maintained), such as cutting machines used for manufacturing or a tractor/trailer for a small agricultural business, then owning your equipment is advantageous.

This may seem obvious, but if the equipment you’re seeking to buy has a long shelf life and strong resale value (if properly maintained), such as cutting machines used for manufacturing or a tractor/trailer for a small agricultural business, then owning your equipment is advantageous.

You May be Eligible for Tax deductions

Even if you purchase new equipment through financing, you may still be eligible to deduct up to 60% of the cost of that equipment under section 179 of the IRS tax code. The same tax code also allows you to deduct the depreciation of your equipment in following years.

You May Get a Boost to Your Credit Rating.

Making monthly on-time payments to your lender for your equipment will go a long way towards strengthening both your personal and business credit scores.

The Cons of Equipment Ownership:

Down payments

Some equipment financing arrangements may require a down payment on the equipment being purchased, and this could be a drag on your cash flow. This is especially true if you use dealer financing or a traditional bank. Alternative (online) lenders, however, often don’t require down payments.

Some equipment financing arrangements may require a down payment on the equipment being purchased, and this could be a drag on your cash flow. This is especially true if you use dealer financing or a traditional bank. Alternative (online) lenders, however, often don’t require down payments.

Getting stuck with outdated equipment

As previously mentioned, outright ownership of equipment has its advantages, but only if the equipment can be used for the long term and has a strong resale value. If equipment – such as a computer operating system – can quickly become obsolete, then ownership most likely wouldn’t be the best solution.

The Benefits of Leasing Equipment:

Minimal initial costs

With the exception of business vehicles, leasing equipment almost never requires a down payment. This allows small business owners to quickly obtain the equipment they need without taking a major hit to their cash flow.

With the exception of business vehicles, leasing equipment almost never requires a down payment. This allows small business owners to quickly obtain the equipment they need without taking a major hit to their cash flow.

Tax deductions

Small business owners may be able to take a tax deduction on lease payments for their equipment, making it even more cost effective.

Outdated equipment can easily be replaced

Small business owners can tailor their lease agreements so that they expire when the piece of machinery or other equipment becomes obsolete. This will enable them to quickly upgrade their equipment to suit their businesses.

Lesser credit scores.

Typically, lease agreements require lower personal and business credit scores than purchasing equipment. Additionally, the duration and the amount of the payment plan can be altered based on the lessee’s credit scores.

The Cons of Leasing Equipment:

Higher monthly payments

The monthly payment in an equipment leasing agreement is usually higher than an equipment financing agreement.

The monthly payment in an equipment leasing agreement is usually higher than an equipment financing agreement.

You don’t own your equipment

Depending on the type of leasing agreement you make, you don’t own the equipment you’re using. Therefore, you cannot benefit from the resale value of that equipment, nor take a tax deduction on the depreciation of that equipment.

The decision on whether to lease or own equipment should depend on such factors as the strength of your business’ cash flow; how long you plan to use your equipment and how much you can afford to pay. These factors should be considered carefully before deciding.

Equipment Financing Across Industries

Equipment financing can be different across various professions and industries, so if your small business falls into one of the industries, such as construction, in which expensive equipment is commonly needed, here’s what to expect.

Heavy Equipment Financing

Construction companies and small businesses in related professions such as roofing or tree cutting services often require the most expensive equipment to operate, and therefore, there are plenty of financing options for them, including financing companies that specialize in lending for heavy construction equipment. This is referred to as heavy equipment loans and leasing.

Heavy equipment lending and leasing firms specialize in financing construction equipment such as cranes, bulldozers, back hoes, dump trucks, RB4000s, and cement mixers. What differentiates heavy equipment lending from regular equipment financing is that there are often terms with heavy equipment financing that allow you to finance equipment once you purchase it, as well as deals to lease to own equipment.

With heavy equipment loans, you purchase the machinery outright and pay a monthly fee with interest until you own the equipment. Since heavy machinery – with the proper maintenance – maintains strong resale value, lenders commonly allow borrowers to finance 100% of the equipment once it is paid off, giving the small business cash for owning their equipment.

With heavy equipment leasing, no down payment is usually required, and the terms usually can range between 3 to 5 years, although that varies with each lender. What sets it apart from regular equipment financing is that the lending company typically allows the borrower to renew their lease or purchase the equipment at market value at the end of the lease.

Equipment Financing for Manufacturing

If your small business manufactures products you’re going to need expensive equipment such as CNC processors, wood- or metal-cutting machines or welding machines. There are firms that specialize in manufacturing loans.

Manufacturing loans work like regular equipment loans except that interest rates and repayment terms are tailored to whether the equipment being bought will increase production and how quickly the borrower will need to upgrade the machine. Most traditional banks and many alternative lenders offer manufacturing loans.

Equipment Financing for Automobiles

If your business relies on vehicles such as limousines, box delivery trucks or long-haul trucks, equipment financing may be a great solution for you, especially if you don’t qualify for dealer financing. Dealer financing or financing through a traditional bank might be a good option if you’re purchasing a single, new vehicle and you have excellent credit. Dealer financing also typically offers a lower interest rate than traditional equipment financing.

If you don’t qualify for dealer financing, or if you’re seeking to purchase a fleet of vehicles, equipment financing through a traditional bank or alternative lender may be a good bet. Several banks and alternative lenders offer equipment financing specifically for vehicles. They can also arrange financing for used vehicles, or flexible financing plans if you plan to replace your vehicles in the next few years.

So, if you’re trying to decide between dealer financing or equipment financing for your business vehicle, consider that equipment financing may offer you more flexible repayment terms, especially if you’re purchasing a fleet of vehicles that you intend to upgrade every few years.

Options Besides Equipment Financing

Equipment financing is a great financing tool for expensive pieces of equipment that will generate sustainable revenue and will still be useful in 3-5 years. However, there are situations when other financing options may be more advantageous.

These options include:

SBA Loans

SBA Loans

As previously stated, SBA loans can be used to purchase equipment and offers lower interest rates than traditional bank loans and equipment financing. This is a good option if you have excellent credit and are able to handle a lot of paperwork.

Bank Loans

Bank Loans

Bank loans, or term loans, are good options because they generally offer lower interest rates than traditional equipment financing loans and are offered by both traditional banks and alternative lenders.

Business Line Of Credit

Business Line Of Credit

If your equipment isn’t that expensive and you need it quickly, a business line of credit may be a great option for you since you won’t need to fill out any paperwork to draw upon it.

Revenue Based Financing

Revenue Based Financing

Revenue based financing is a type of financing in which a lender will give you a lump sum of money upfront in exchange for a percentage of your future sales. This could be a good option if you need equipment quickly and you believe that the new equipment will dramatically increase your revenue.

Qualifications for Equipment Financing

Different lenders may have slightly different qualifications for equipment financing. Generally however, in order to qualify for equipment financing you will need:

Strong personal and business credit scores;

A Strong cash flow to justify the cost of equipment;

A plan on how you will use the equipment;

A minimum number of years in business (often 2-3 years), and

Bank statements and business identification.

Equipment financing can be a great financing tool to grow your small business and conveniently and quickly purchase what you need to allow your business to operate. New equipment can ramp up your sales, increase production or allow you to build a new product or offer a new service. Equipment, however, can be expensive. If you intend to purchase equipment, it’s important to carefully consider your financing options beforehand, as well as how flexible you need the repayment plan to be. Do your research to find a lender that can offer you the best terms and pricing.

Table of Contents

Who Offers Equipment Financing?

What Should you Consider Before Taking out Equipment Financing?

Differences Between Equipment Financing and Dealer Financing

Equipment Ownership vs. Equipment Leasing

Equipment Financing Across Industries

Equipment Financing for Automobiles

Qualifications for Equipment Financing