We Make Lines of Credit Simple

Whether you’re looking to grow your business, run daily operations, or maintain a safety net to stabilize cashflow for the unexpected, Kapitus has financing to a loan fit to your unique business needs.

Why Consider a Line of Credit with Kapitus?

Running a business can make life very unpredictable, with unforeseen equipment repairs, seasonality disruptions & more. A business line of credit gives you the flexibility to cover expenses that are too large for a credit card, typically at a lower interest rate. On top of this you only pay interest on the amount you use. Having continuous access to working capital and ensuring balanced cash flow even during the craziest of times has never been easier.

We Offer Financing Loans for Every Business Need

FAQs

How long does it take to get approved for a business line of credit?

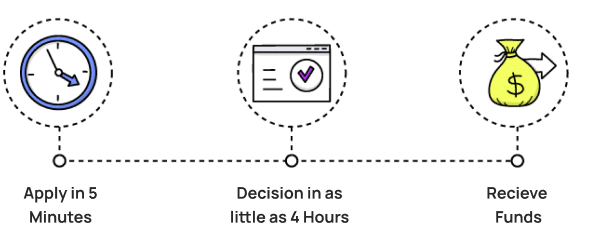

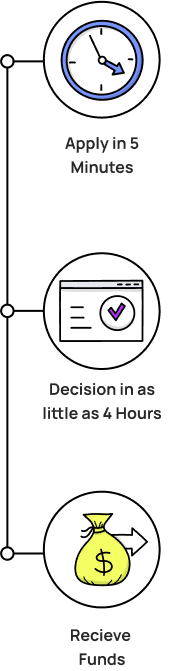

Getting approved for a line of credit can be an extremely quick and painless process. As long as you have all your documentation ready to submit, you can get approved in as little as 4 hours. Upon approval, you can expect to get access to your credit line, again, within 4 hours.

How large of a line of credit does my business need?

Overall, the size of your credit line is dependent on what you plan to use the funds for, and only you can determine this amount. However, it’s important to remember that the size of the line that you would like to get and what you are approved for may be very different. When determining your credit line size, several factors are considered, which can include:

- Your revenue

- Your time in business

- Your business and personal credit scores

- Your industry

Lines of credit with Kapitus can range from $10,000 to $250,000.

How does a business line of credit differ from a business credit card?

There are a few major differences between a business line of credit and a business credit card. For starters, a standard business credit card functions similarly to a personal credit card, in that you can’t just draw cash directly from the card account into your operating account to cover an expense (i.e. you can’t use a business credit card to cover your payroll). When it comes to credit limits and terms, business credit card approval is mostly based on your personal credit score. A line of credit, on the other hand, offers more flexibility on approval amounts, typically has lower interest rates, and can be used to pull cash into your operating account to cover operational expenses or address seasonal revenue shortages.

There are, however, more defined terms on a line of credit. While a business credit card will continue to revolve so long as you make the minimum payment, a line of credit must be paid back within the amount of time agreed upon with your lender and expires after an agreed period. Both credit cards and lines of credit have a credit limit that can’t be exceeded.

If you’re trying to decide between a business line of credit or a business credit card, think about what expenses you are looking to get covered. If the expenses require cash-on-hand, then a business line of credit could be a better option for you. However, if the expenses can be covered with credit, you may prefer to go with a credit card.