$7 Billion

$7 Billion

in capital provided

65,000

65,000

businesses funded

Reviews

Reviews

4.6

Find Line of Credit Terms That Work for Your Business

A Business Line of Credit through the Kapitus financing network is built based on your business’s unique and specific needs. You tell us what you need and our financing specialists will do everything in their power to get you the line of credit that gives your business the flexibility it needs for long-term success.

Why business owners choose Kapitus to compare line of credit offers

Small business owners come to Kapitus for our fast, hassle-free application process and quick approvals.

Why Choose Kapitus for Your Business Financing

We provide fast, hassle-free Financing

with minimal paperwork and quick approvals.

Flexible Access to Capital

Draw funds when you need them and only pay interest on what you use, giving your business financial flexibility.

Fast, Simple Process

Transparent terms with no surprises

No Hidden Fees

Transparent terms with no surprises.

Customer Satisfaction

Rated 4.6/5 stars by thousands of happy business owners.

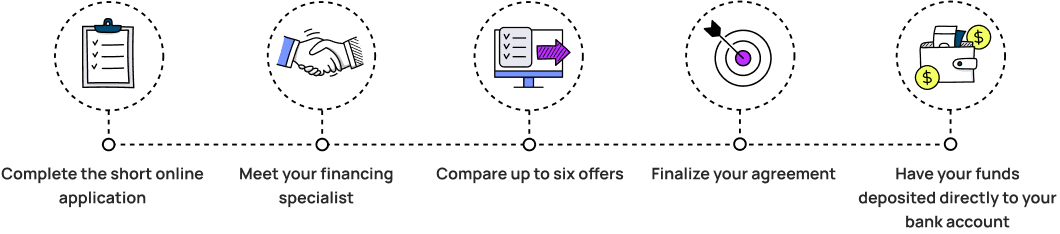

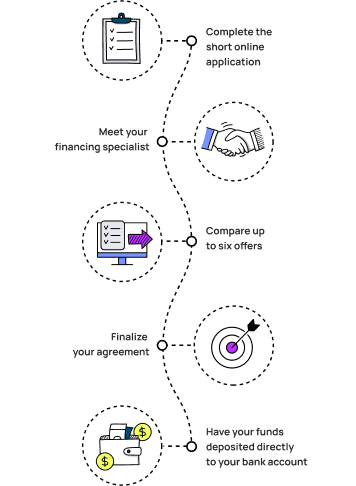

Apply for a Business Line of Credit in

5 Simple Steps

Let’s Make Sure We’re a Good Fit!

Business line of credit offers are designed to help businesses succeed, but there are minimum requirements that must be met.

2+ Years

$250K

650

USA

Don’t meet all of the criteria? Kapitus may be able to help you access other financing options.

Give us a call to discuss what other financing options may be suitable for your business needs: (646) 630-7618.

Trusted by Small Business Owners for Almost 20 Years

Thousands of business owners put their trust in Kapitus each year to help them access business loans.

FAQs

What is a business line of credit?

A business line of credit allows access to a predetermined amount of funds when you need it while only paying interest on the actual amount used. No unnecessary complexities. Draw and repay as you go for a truly flexible and revolving credit option.

What are the Pros and Cons of a business line of credit?

As with all other types of small business financing, a business line of credit comes with benefits and drawbacks when compared to other financing options. Here are some pros and cons to weigh when comparing types of loans and financing.

Business Line of Credit Pros

- Revolving line of credit

- Cash flow flexibility

- Only pay interest on funds you draw

Business Line of Credit Cons

- Variable interest rates

- Inconsistent repayment amounts

- Risk of over-drawing

How can I use my business line of credit?

Your Business Line of Credit is built to handle any needs that may come up during your operations. A line of credit provides your business with a financial cushion to help guard your working capital and keep operations running smoothly.

Product availability is subject to confirmation of eligibility and underwriting. Products may vary based on credit profile and the state in which your business is located. Certain products may not be available in all states or to all customers. Business loans made or brokered by Kapitus in California are made or brokered by Strategic Funding Source, Inc. d/b/a Kapitus pursuant to California Finance Lenders License No. 603-G807. SBA loans, business lines of credit, invoice factoring, and purchase order financing are offered only by members of Kapitus’s financing network and not by Kapitus directly.