$7 Billion

$7 Billion

in capital provided

65,000

65,000

businesses funded

Reviews

Reviews

4.6

What are SBA loans?

SBA loans are government-backed financing that allows lenders to offer small businesses more favorable terms and more flexible underwriting criteria than conventional loans. Because these loans are backed by the U.S. government, they often require lower down payments, have longer repayment terms and greater accessibility.

Benefits of getting an SBA loan from a member of Kapitus’s financing network:

Industry expertise

Our financing specialists have guided thousands of businesses through the application process.

Improved cash flow and growth

Borrow up to $5 million with terms up to 25 years, capped interest rates and flexible use for operations, real estate or partner buyouts.

Multiple program options

Access SBA 7(a) loans for flexibility and SBA Express loans for expedited funding in as little as 14 days.

Capped interest rates

Rates are negotiated between borrower and lender but cannot exceed SBA maximums. They vary by loan size, industry and terms.

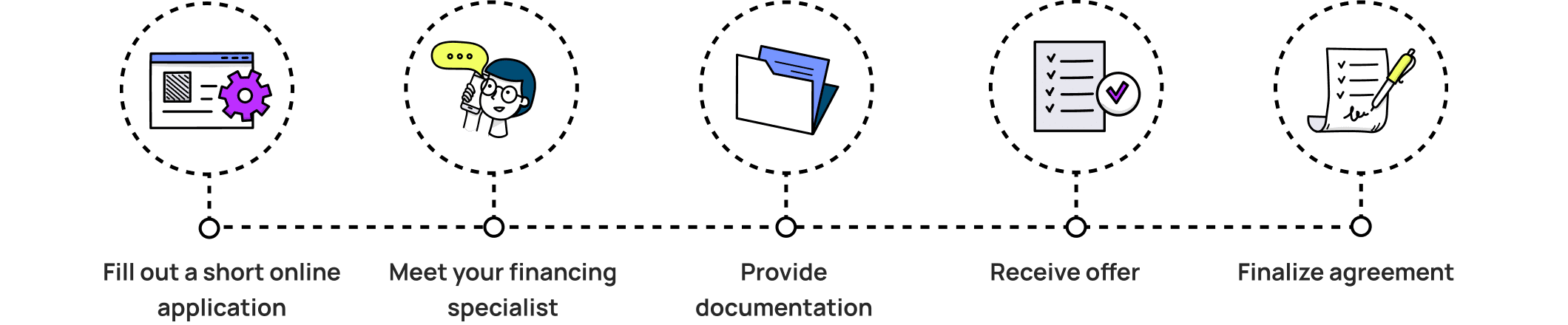

Applying for your SBA Loan

Minimum requirements to qualify for SBA loans

- You must own a U.S.-based, for-profit business.

- You must have fewer than 500 employees.

- Your business must operate in an SBA-approved industry.

- You must demonstrate both creditworthiness and the ability to repay the loan.

- You must have established business credit.

- Your average annual receipts must not exceed $7.5 million over the past three years.

- You must have fully exhausted all other reasonable non-SBA financing options.

- You must show invested equity.

Understanding SBA Loan Requirements

SBA loans are typically more affordable but can be harder to obtain due to strict requirements and paperwork.

Credit Scores

Strong personal and business credit are essential because the SBA backs a portion of your loan.

Invested Equity

The SBA expects that business owners are personally invested in their businesses.

Trusted by Small Business Owners for Almost 20 Years

Thousands of business owners put their trust in Kapitus each year to help them access business loans.

More on SBA loans:

Is it hard to get an SBA loan?

Yes. Strict requirements and paperwork are involved, but long terms and low rates often make it worthwhile.

How long does it take to get funding?

Standard 7(a) loans can take, on average, 60–90 days. Express loans, on average, can take 30–60 days. However, it’s important to remember that there is no exact timeline. The length of the process can vary significantly from business to business based on multiple factors.

1 Product availability is subject to confirmation of eligibility and underwriting. Products may vary based on credit profile and the state in which your business is located. Certain products may not be available in all states or to all customers. Business loans made or brokered by Kapitus in California are made or brokered by Strategic Funding Source, Inc. d/b/a Kapitus pursuant to California Finance Lenders License No. 603-G807. Certain types of loans, such as SBA loans, are offered only by members of our financing network.