Customer Service (800) 780-7133 ![]() Sales (646) 630-7618

Sales (646) 630-7618

$7 Billion

$7 Billion

in capital provided

65,000

65,000

businesses funded

Reviews

Reviews

4.6

Find the Best Business Loan for Your Needs

Whether you’re looking to fuel growth, cover operational costs, or address unexpected expenses, you have a variety of options available for you to explore – from short-term loans to SBA loans.

Kapitus financing specialists take a consultative approach to business financing. We get to know you and your business to help you weigh your options and choose the best business loan for your current needs, without over-extending your business.

Why Choose Kapitus for Your Business Loan?

Small business owners come to Kapitus for our fast, hassle-free application process and quick approvals.

Why Choose Kapitus for Your Business Financing

We provide fast, hassle-free Financing

with minimal paperwork and quick approvals.

Flexible Funding Options

We offer a solution tailored to the unique needs of your business.

Fast, Simple Process

Apply online in minutes, get approved in as little as 24 hours, and receive funding quickly.

No Hidden Fees

Transparent terms with no surprises.

Customer Satisfaction

Rated 4.6/5 stars by thousands of happy business owners.

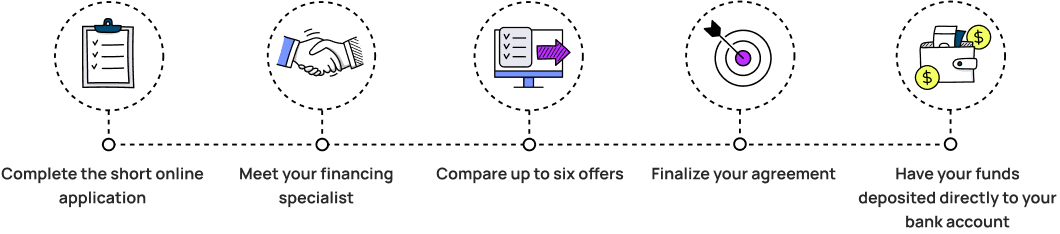

Apply for a Business Loan in

5 Simple Steps

Let’s Make Sure We’re a Good Fit!

Our business financing is designed to help businesses succeed, but there are minimum requirements that must be met.

2+ Years

$250K

650

USA

Don’t meet all of the criteria? Kapitus may be able to help you access other financing options from members in our financing network.

Give us a call to discuss what other financing options may be suitable for your business needs: (646) 630-7618.

Trusted by Small Business Owners for Almost 20 Years

Thousands of business owners put their trust in Kapitus each year to help them access business loans.

FAQs

What is the minimum credit score for a small business loan financed by Kapitus

At this time, the minimum credit score requirement for our small business financing is 650.

How is working with an online lender different than working with a traditional bank?

There are a variety of reasons that business owners will choose one type of provider over another – and each has its advantages and disadvantages. To further explore the differences, check out Traditional Bank vs. Alternative Lender.

What other business financing options can I access by working with Kapitus?

Kapitus can help you explore a full suite of financing products and help you explore all your options at the same time. Did you know that a term loan is not always the best option in every situation? Depending on why you need financing, the speed at which you need it, and terms you would like to see, there are alternative financing products that could be a better fit. Some additional financing options we can help you explore include:

- Business line of credit.

- Revenue-based financing.

- Equipment financing.

- Invoice factoring.

- Purchase order financing.

1 Product availability is subject to confirmation of eligibility and underwriting. Products may vary based on credit profile and the state in which your business is located. Certain products may not be available in all states or to all customers. Business loans made or brokered by Kapitus in California are made or brokered by Strategic Funding Source, Inc. d/b/a Kapitus pursuant to California Finance Lenders License No. 603-G807. Certain types of loans, such as SBA loans, are offered only by members of our financing network.